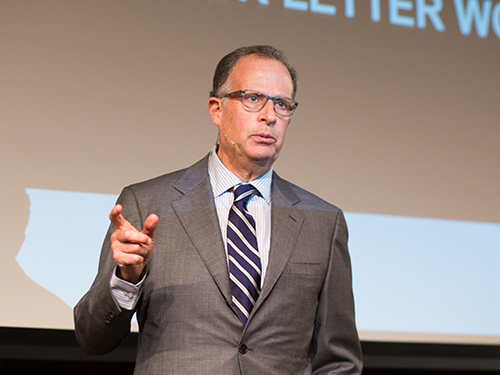

Edward Kleinbard, Johnson Professor of Law and Business at USC, returned to the Hilton stage for the second time as part of the Center for Accounting Ethics, Governance, and the Public Interest’s Distinguished Speaker Series. Originally, Kleinbard was scheduled to speak on tax reform but he changed his topic because things are simply too uncertain. Instead, his lecture focused on government redistribution and fiscal policy.

Kleinbard is a strong proponent for a larger government which he believes will lead to more economic growth. He says government exists to spend, not to tax. Government should purchase investments and insurance with money raised through taxes.

“The economic pie gets bigger when government complements the private sector,” said Kleinbard. “Small-government mentality beggars our future and adds to inequality.”

Contrary to popular belief, the U.S. is a low tax, small government economy that does very little redistribution. Kleinbard illustrated this point by comparing the U.S. to Germany, a country which instates a 10% higher tax rate yet has considerably lower levels of inequality. Though Germany’s tax system is less progressive, it has a strong commitment to public infrastructure and insurance. And while the U.S. has the most progressive tax system of all countries, it also has one of the highest levels of inequality.

In 2015, the Organization for Economic Cooperation and Development (OECD) stated that rising income inequality has a significant impact on economic growth, in large part because it reduces the capacity of the poorer segments – the poorest 40% of the population – to invest in their skills and education. For example, the U.S. spends more on public education of rich kids than poor kids. Even mediocre rich kids are getting into the best universities and snagging the most high-paying jobs.

These economic issues drive social anger which results in several trends: rising top-end inequality (top 1% controls 42% of national wealth), fading belief in equality of opportunity and stagnant incomes of the middle class lead to rage at working harder but falling further behind, conviction that the game is rigged against us, and repudiation of connection to fellow Americans. The U.S. also has the highest adult poverty rate as well as the highest ratios of rich to poor in the OECD.

The future of the U.S. depends on us working together as a democracy. The fiscal soul of the U.S. is in peril and something must be done. As citizens, we must have institutionalized empathy and connect with our fellow Americans through common action.

Click here to access Ed’s full presentation on video.